Simultaneously, for us owners or expats surviving in the united kingdom, your domestic condition things equally as much. Instead of United kingdom people, People in the us are susceptible to taxation on the global income by the the inner Revenue Service (IRS), regardless of their house position. This will make information your own United kingdom domestic position important to stop double income tax. Before you start the process discover long lasting home in the uk, it’s crucial that you understand the will cost you involved. The application costs can transform based on your own nationality plus the particular form of visa you are making an application for. The guidelines to have making an application for long lasting home in the uk depend in your situation as well as the immigration channel you choose.

You’ll score an enthusiastic eVisa (an internet number of your own immigration status). The net was created getting a scene rather than boundaries, yet region-closed content, censored suggestions and you may walled-away from features occur all around us. There’s a powerful way to treat such methods when you are leftover secure and you will anonymous on the internet — ExpressVPN. That have super-prompt machine inside 94 nations, 24/7 customer care and a good 31-go out risk-free currency-right back be sure, make ExpressVPN the decision to own sites liberty. Begin by understanding the around three main areas of the brand new SRT- the newest automated to another country screening, the newest automated Uk tests, as well as the adequate ties test.

You.S. Charge Invitation Letter Publication with Test Letters

When you have an eVisa, you could potentially update your personal data in your UKVI account, such as your contact details. This really is a totally secure services and you will allows you to show the status having prospective employers, universities, or other companies. You’ll discovered a decision find that may set out the causes the job are denied. If you’d like to changes anything on your software when you’ve delivered it, for example a great spelling mistake, or an improvement from points, get in touch with British Visas and you can Immigration (UKVI). And the charge payment, for every loved one which pertains to arrive at the united kingdom with you must along with shell out a fee.

Delivering an internet immigration position (eVisa)

Should your condition is unsure, you ought to search specialist guidance to find a proper viewpoint and you can related information. Comprehend our article concerning the differences between casino Platinum Reels review domicile and you may residence to have more descriptive expertise on the how house and you can domicile try ultimately some other. Dividend money, interest, or other offers money try taxable in case your supply of you to earnings is in the Uk, even though excite come across below out of overlooked earnings.

Applying with your college students

The first automated to another country try can be applied if you spent fewer than 16 months in britain inside current tax year and was a great United kingdom resident in a single or more of the around three before tax many years. The brand new HMRC automated to another country tests are the 1st step in the Statutory Home Attempt processes. They determine if you aren’t a great British resident considering specific things like your months invested in the uk and performs models.

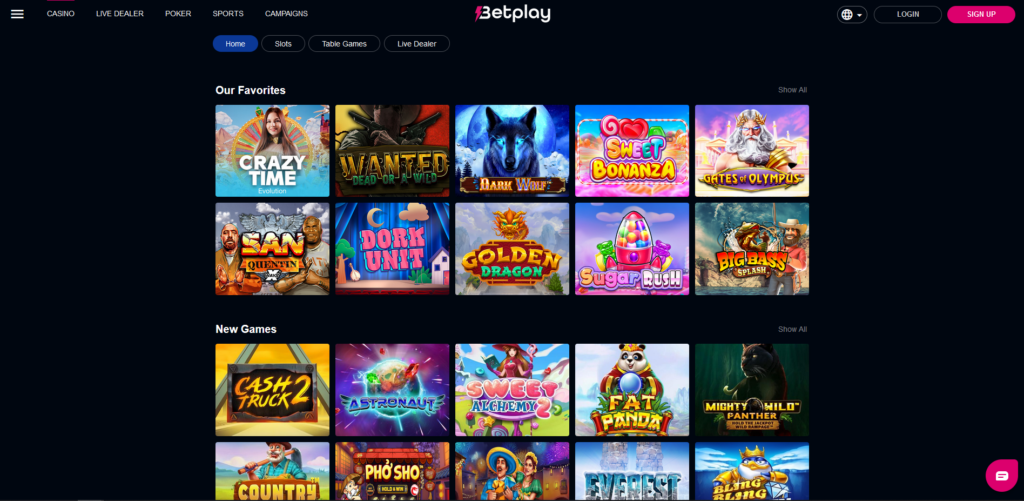

- They enable you to have fun with the same online game you will find inside the the actual currency casinos free, along with the possibility to discover real cash honors.

- It offers the right to real time, functions and read here so long as you like, and apply to have pros for individuals who’re-eligible.

- Still, opening a good Uk family savings is a crucial 1st step in the undertaking a cards footprint in the united kingdom.

- The brand new Statutory Household Sample comes with specifications for ‘exceptional points’ that may affect the days spent in the uk.

- You earn the IBAN membership count and a smart debit cards to spend in the Euro and 140+ nations inside local money.

- This is basically the option your’ll choose if you want to relocate to the uk permanently, and require the right to live, performs and study truth be told there so long as you adore.

When moving to a new nation, knowledge the rights in order to healthcare services is the key. Also, owning property in britain can impact your house position under the Legal House Try. Whenever offering a property, United kingdom owners could be at the mercy of Money Gains Tax to your people profits, with some exclusions, such as the product sales out of a first household. However, deciding on the remittance foundation can result in shedding some tax allowances and may also include a yearly charge for many who’ve been a great Uk resident for a specific amount of income tax years. Introduced inside 2013, the new SRT will bring a definite, step-by-step strategy to present if or not an individual is a good British resident to have taxation motives.

United kingdom owners

- Should your application is successful, you’ll discover a decision notice that boasts the fresh requirements of one’s grant from permission to stay in the uk.

- DVLA use your email to test when you have a motorist and you can auto membership.

- Hulu enables you to observe the new attacks alive (through the FOX website), also it makes making up ground effortless while the all previous year are included in the service’s to your-request collection.

- This might are local rental income out of United kingdom property otherwise a job money to own functions done in the united kingdom.

However, a potential drawback would be the fact digital financial institutions may well not deliver the thorough financial functions obtainable in antique banks. However, they offer a feasible substitute for low-residents who has difficulties opening a traditional checking account. Virtual financial institutions such Monzo and you may Revolut offer features to help you non-owners, bringing a merchant account amount, types password, and you will debit cards for within the-store an internet-based purchases. So it simplifies the new procedures for individuals instead of Uk address documents. However, understand that setting up an online banking account generally needs as much as 3 to help you 4 weeks to do.

If you’re also a partner, companion or cherished one of someone who has British citizenship otherwise settlement in the united kingdom, you can apply for a family visa to join him or her. But in realization there are two main areas where non residents usually most likely pay taxation. You want the newest local rental income, the job and also the leverage of a home loan to obtain the larger efficiency. The main differences when purchasing from to another country might be costs. (We’ve moved on the far more detail from the paying stamp obligation of to another country here).

When you should Declare H-4 Visa Renewal in the event the Companion is changing Work to your H-1B Visa

You may also submit an application for an international savings account on line inside any of these better British banking companies such HSBC, Barclays, Lloyds, NatWest, an such like. Traditional bank accounts just work in one currency and another country. And you need to confirm your regional residence to start an excellent savings account in every local money. The new taxation laws and regulations for low-people are other, and also as a low-citizen you will have to over supplemental models. Non-people are also likely to discovered non-United kingdom centered money of employment, financing development or any other provide, and this requires more reporting. Non-United kingdom residents are probably be susceptible to the fresh income tax regulations of another legislation that will mean you will find income tax treaties to take into consideration.

For individuals who now have an eco-friendly Cards or try waiting for your application as accepted, let the You.S. Citizenship and Immigration Services (USCIS) discover your target immediately. Find out more about updating your address through your USCIS account and you can utilizing the Business Changes from Target (E-COA) self-provider equipment. Whether or not your’lso are concerned with tax, funding progress, or genetics income tax effects, we assurances their tax believed try productive, certified, and customized on the demands. The newest Statutory Residence Attempt Flowchart are an artwork tool made to explain the whole process of choosing their tax residence position from the British.

With this extreme move, your own residential status you are going to key away from ‘non-resident’ to help you ‘resident’. Alternatively, for many who’ve started residing great britain however, plan to retire within the sunny The country of spain, you could changeover of are a good ‘resident’ so you can a great ‘non-resident’. Knowledge these types of things and how it work together is vital to totally leveraging the advantages of their home-based position while the an expat.

Playthings or dummies are prohibited becoming found in the picture. For the kids below age six, it don’t must look into the camera’s lens. An excellent Uk home card is files that works well much like an excellent Charge. They permits individuals to real time and work in the united kingdom, having a validity of up to five years.

If you already had a great British retirement following moved to another country, your perhaps in a position to keep you to definitely pension. Not just that, however in most cases, you could potentially nonetheless lead tax-free to own an occasion and ought to manage to withdraw from it inside the retirement. The key cons is actually large fees being committed to risky things wear’t know. They are often located in urban centers that have favourable tax regimes such because the Ireland, Luxembourg, The fresh Route Countries and also the Isle of Son.